In the rapidly evolving digital banking landscape, Niyo Global Card has emerged as a promising solution for individuals seeking seamless international transactions and enhanced financial control.

Are you a frequent traveller? Or do you want to enrol for higher studies abroad? If you answer yes, you must be aware of the hassle of carrying currency in different countries.

To make things simpler and faster, a niyo global card for students and travellers is the perfect solution to make your life easier.

This blog will take an in-depth review of the Niyo global card’s benefits, features, drawbacks, etc.

What is the Niyo Global Card?

Niyo Global Card is a prepaid foreign currency card allowing users to access their funds in Niyo Global Card-accepted countries easily. It is a digital card that can be used in more than 200 countries and is powered by Mastercard and VISA.

The Niyo Global Card was offered by Niyo Global which is a fintech company. The company has tie up with banks in India to offer various financial services such as Saving Accounts, Debit cards, credit card, etc.

The card is loaded with many foreign currencies like US dollars, Euros, and Pound Sterling, and it is accepted in all major currencies.

It is a great way to manage your finances while travelling, especially for students who are going to pursue studies abroad, and it also offers attractive benefits.

Along with the card, you get a full banking experience and a free bank account powered by SBM Bank of India.

Benefits of Niyo Global Card

Niyo Global Card is a unique new product offering cardholders many benefits. Some of the vital niyo global card benefits are –

1. Easy application process

Complete 100% digital account opening and KYC through the Niyo App.

You can get your best international travel card and instant zero-balance savings account within minutes without any rush to other banks’ offline processes.

2. High Security

Niyo card is a Safe and secure way to carry your money while travelling. As a Niyo global card, SBM provides enhanced security features like lock/unlock/permanent block card features.

The card is equipped with a chip and PIN security feature, which makes it more secure than traditional magnetic stripe cards. This helps to protect your funds from being accessed by anyone else.

3. Convenience

Niyo global card is accepted in many countries. You don’t have to worry about carrying different currencies as the card is accepted in all major currencies.

With your digital account, you can quickly load foreign currency through NEFT/RTGS/IMPS without bearing any additional charge.

Further, the Management of Card limits plays a vital role, especially if you are travelling abroad. You can control the card’s limits within the Niyo global app and get your money insured for up to ₹ 5 lakh with RBI.

4. Cost Savings

- It is a cost-effective way to access your money as it is available at a low cost, and no hidden niyo global card charges disturb your planning.

- Offers a great niyo global card exchange rate for students, so you don’t have to worry about losing money due to fluctuating exchange rates.

- Earn 5% interest p.a. on your SBM saving account with monthly interest payout and ₹200 on every successful referral from your account.

- Complimentary lounge access at the airport with the niyo global card lounge access both in the domestic and international terminals across India through a VISA signature card.

Features of Niyo Global Card

Niyo Global Card is a prepaid travel card that can make secure, convenient, and cost-effective payments while travelling abroad. Over 30 million merchants accept the card, and it can also be used for online shopping.

The attractive niyo global card features make an ideal choice for travellers and international students, which include the following:

1. Multi-Currency Support

Niyo Global Card supports multiple currencies, allowing users to load and transact in various foreign currencies without incurring additional conversion fees.

2. Real-Time Forex Rates

Users benefit from real-time forex rates, ensuring transparency and accurate calculations for their international transactions.

3. Expense Tracking

The associated mobile app enables users to track expenses, set budgets, and receive instant notifications for every transaction, offering a comprehensive overview of their financial activities.

4. Zero Forex Markup

While making big-ticket payments related to university and tuition fees or transactions, including flight booking, there are zero markup fees compared to other international debit or forex cards the banks provide.

With Niyo Global Card, any Indian Traveler can do international transaction without any extra charge. Most of the banks charge 2-5% towards transaction charges. And this makes a better travelling card than a forex card.

5. Contactless payments

The card supports contactless payments (powered by VISA), so you can simply tap your card to pay for any type of purchase.

6. Free withdrawals

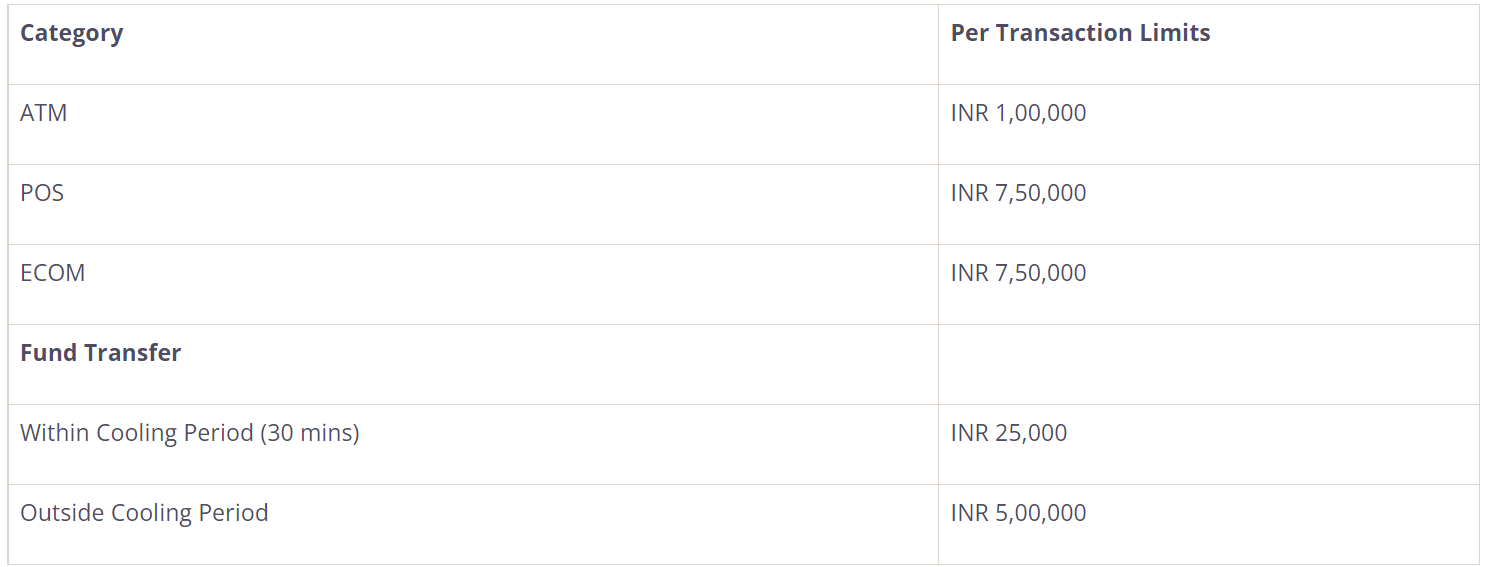

With the Niyo Global Card, you can make free withdrawals at over 1 million ATMs within the specified limits as mentioned below –

7. Zero TCS

With Niyo Global Cred Card, there is no TCS on unlimited International transaction which is a most attractive service for high end traveler or students.

8. ATM locator and 24×7 customer support

Wherever you travel, you can track the nearest ATM in case of fund withdrawal urgency. You can also contact Niyo Global Card customer care for faster resolution on a real-time basis.

The Niyo Global Card has several features that make it an attractive option for students, and this card is a much better option than any other existing Forex card.

How to apply for Niyo Global Card

Now, the biggest question that comes into your mind is how to apply for a Niyo global card.

Well, the process of applying for a Niyo Global Card is quite simple. You can get a niyo global card and a free SBM digital account instantly by adopting a simple process –

- Download Niyo Global app,

- Enter basic details, including your name, address, and contact information,

- Complete the KYC process with your PAN, Passport, and AADHAR card,

- Enjoy a digital account and card experience on the app,

- Load ₹ 5,000 in the SBM savings account to place an order for a physical card,

- You will get your physical card at your doorstep within 15-20 days.

How to use a Niyo Global Card

After a successful SBM digital account opening and Niyo Global card, you might learn how to use the Niyo Global card. Using a Niyo Global card is quite simple.

The Niyo Global Card is a prepaid card that can be used to make purchases anywhere in the world. The card is loaded with foreign currency, so there is no need to worry about exchange rates.

The card can be used at ATMs to withdraw cash, and it can also be used to make online purchases.

The Niyo Global Card is a great way to avoid fees associated with foreign currency exchange.

Is Niyo Global card safe?

The Niyo Global Card is a safe and secure way to access your funds while travelling.

As a prepaid card, you can only spend what’s loaded onto it. Plus, it has built-in security features like pin protection and transaction limits, so you can rest assured that your money is safe and secure.

This helps to protect your funds from being accessed by anyone else. Also, if you lose your Niyo Global card, you can instantly block your card from the app. It has partnered with SBM bank, Equitas Small Finance Bank and DCB Bank.

Further, the amount up to ₹5 lakh is insured by Deposit Insurance Scheme by DICGC which is a subsidiary of the Reserve Bank of India.

Charges for using Niyo Global card

The Niyo Global Card is available at a low cost and has no hidden charges. However, there are some charges associated with using the card, including the following –

- Loading fee of ₹ 5,000 at the time of ordering a physical card,

- Other bank ATM withdrawal fees of ₹ 20 per transaction after crossing a limit of 5 transactions per month in India,

- International ATM cash withdrawal and balance inquiry fees of ₹ 500 per transaction,

- A foreign exchange fee applies to the amount spent internationally.

List of Charges for Niyo Global Card

| Services | Niyo Global Credit Card | Niyo Global Debit Card (Equitas Bank) | Niyo Global Debit Card (DCB Bank) |

|---|---|---|---|

| Account opening charges | Zero | Zero | Zero |

| Card charges | No annual charge | Issue fee = ₹199 + GST (refunded on first load of ₹1,000 or more) | ₹500 + GST (waived off on average quarterly balance of ₹5,000) |

| Zero Forex | No Charges except VISA exchange rate | No Charges except VISA exchange rate | No Charges except VISA exchange rate |

| Tax Collected at Source (TCS) | Zero TCS on unlimited international spends | Pay Zero TCS for international spends up to 7 lakh | Pay Zero TCS for international spends up to 7 lakh |

| International ATM withdrawal charges | ₹500 + GST or 2.5% of the transaction amount (whichever is higher) | ₹499 per transaction (₹422.88 + 18% GST) | ₹300 + GST |

| Zero balance account | Nil | Nil | Nil |

| Interest rate | Upto 7.25% p.a. on your FD | Upto 7.8% p.a. on savings a/c | Upto 8% p.a. osavings a/c |

| Airport lounge | Free airport lounge access in India | Free airport lounge access in India | Free airport lounge access in India |

| Acceptance | 150+ countries | 150+ countries | 150+ countries |

| Daily UPI limit | – | ₹1 lakh | ₹1 lakh |

Niyo Global card alternative

If you are looking for a Niyo global card alternative, a few options are available. You can use a travel money card, similar to a prepaid card but designed specifically for travelers.

You can also use an international debit or forex card, which allows you to access your funds in multiple currencies.

Finally, you can use a credit card that offers a great exchange rate and is accepted in most countries.

Niyo Global Card accepted Countries.

The Niyo Global Card is accepted in more than 200 countries, so you don’t have to worry about carrying multiple currencies.

Some countries where the card is accepted include the United States, Canada, the United Kingdom, Australia, New Zealand, India, Singapore, Malaysia, Vietnam, and many more.

Who can use the Niyo Global Card?

The Niyo Global Card is available for individuals and businesses. Individuals can use the card to make payments while travelling, and businesses can use it to make payments in multiple currencies.

This card is also a great option for students studying abroad as it offers a great exchange rate and is accepted in more than 200 countries.

Which bank issues Niyo Global Card?

Niyo Global card is issued by the SBM Bank of India, an RBI-licensed and registered bank, and as per RBI directions, all the money up to ₹ 5 lakh is covered by insurance.

Therefore, you don’t need to worry about the balance amount deposited in the Niyo Global card or the SBM savings account.

Disadvantages of the Niyo Global Card? (Potential Drawbacks):

From the viewpoint of students and foreign travellers, this card is the best alternative to any other type of Forex card. However, it also has disadvantages. Some of the important cons of the niyo global card are:

1. Transaction fee

The one disadvantage of the Niyo Global card that we have encountered is a levy of fees of ₹ 100 per transaction on international ATM cash withdrawals and balance inquiries.

2. Limited Acceptance

While widely accepted, there might be instances where certain establishments do not support prepaid forex cards, requiring users to have an alternative payment method.

3. Initial Loading Time

The time required for the initial loading of funds onto the card may be a consideration for users needing quick access to funds.

Final Thought on Niyo Global Card

In conclusion, the Niyo Global Card is an excellent way to manage your finances while travelling outside Indian territory.

It is a safe and secure way to access your funds in multiple currencies, and it also offers attractive benefits such as lounge access in more than 80 international airports.

The card is accepted in over 200 countries, so you don’t have to worry about carrying multiple currencies.

The Niyo Global Card emerges as a comprehensive solution for individuals seeking a hassle-free, cost-effective, and secure means of managing international transactions. Its innovative features and emphasis on financial control represent a noteworthy option in global banking.

In conclusion, for those looking to simplify their international financial experiences and reduce costs associated with traditional banking, the Niyo Global Card is worth considering.

Frequently Asked Questions (FAQs)

Who can apply for the Niyo Global Card?

All Indian residents with valid Indian Passport and over 18 years of age can apply for the Niyo Global travel Card.

Whether Niyo Global offers debit or credit cards?

Niyo Global offers debit and credit cards with its partners banks in India. SBM Bank, DCB Bank and Equitas Small Finance Bank are its partner bank in India.

How to add money to your Niyo Global Travel Card?

You can add money to your Niyo Global Card either through UPI or through direct Bank Transfer (RTGS/NEFT).

Disclaimer: The above article is for education purpose only and the website will not have any liability or loss occurred due to usage of above card. Further, we also don't endorse any actions or features of the card. So it is requested to always look for latest information on Niyo Global card website.

Subscribe to our weekly newsletter and never miss the latest TIPS on Smart Income Ideas to Make Money Online. No Spam, No promotion. You will get only one newsletter per week. Get your copy now