Investing your hard-earned money could be challenging for many beginners. In this post, I will share the steps to identify the best opportunities to invest your money smartly.

It doesn’t matter whether you start with 10$ or 100,000$. Investing is important. Even a baby step taken towards investing is more than enough.

More than investing, it is most important to invest in the right direction. One wrong step, and you will pay a heavy price.

So before investing, you should be aware of the financial or non-financial investment options available in India. You should know how to invest money to get a high return with less risk.

This article is going to any person who is an earning member in his family and wants to grow their savings. It is also useful to persons who are not earning member-like students because they would also join the workforce in the future.

After reading the article you would be able to find out –

- how to invest your money wisely for beginners,

- the best way to invest your money,

- where to invest money to get a good return,

- best and safe investment plan with a high return in India,

- low-risk investments, high-risk investments, etc.

I would share my secret tips in the last section of the article. You can also watch the detailed video I have published about how to choose the best investment option to get a high return in India?.

You would also know why investing money is essential for everyone.

Table of Contents

Steps to choose the best option for investing:

If you are here then I assume that you are serious about investing because most people think investing is a boring subject. So let’s start…

Whenever you think about investing, I am sure the first things that come in your mind is-

Why should you invest?

Reason 1: Improves spending habits.

When we were in college we had been surviving on a very tight budget. Once we start earning we tend to fulfill all our wants and requirements like- branded clothes, expensive mobile, partying, holidaying, etc.

In this process, we forget to save money and this becomes part of our lifestyle. So, savings is the last thing that comes to our mind.

The best part of automated investing is that once you start a regular investment even in a mutual fund SIP, you become disciplined. Which will finally improve your spending habits in the long run.

Reason 2: Long-term wealth creation.

Earning a handsome amount per month is always good, but investing that money in the right financial instruments is essential for long-term wealth creation.

Even if you start investing with a very small amount, you multiply your wealth in the long run. So an early start can help you to accumulate a good corpus and achieve financial freedom.

For Example, a monthly SIP of Rs.20,000 for 30 years with annual returns of 12%, your investment worth after 30 years would be approximately 7.06 Crore rupees.

Systematic Investment Plan(SIP) Calculator

Reason 3: Save yourself from the effect of Inflation.

Saving a good portion of your monthly salary is the first step towards financial freedom. But the most important action to create good wealth is investing those savings in the right investment options to build a good corpus for retirement.

If you keep your savings in the banks, you cannot beat inflation, and your absolute return will be negative. Unless you beat inflation, you cannot accumulate sufficient corpus for retirement.

For example, the interest on a savings account is about 3.5 % in India but the historical average inflation rate is around 6%. It means your net return on investment is -2.5% (6% – 3.5%). So basically, your savings are depreciating @2.5% per annum.

Reason 4: To Benefit from Compounding.

Compounding is considered the 8th wonder of the world. If you want to reap the benefit of compounding, you would have to start investing your money as soon as possible.

The real benefit of compounding is that even with a small investment on a regular basis, you can create a huge wealth in the long run.

So I am sure you got your answer to why you should invest.

Top 8 Reasons why you must invest in the stock market.

The next question is-

What is your goal of investment?

Fixing your goal is very important.

Let us suppose you start a journey but don’t know your destination. In that case ,you can not decide the time required for the journey, your expenses during the journey, things to do after reaching the destination, etc.

So, overall it will be a mess even though you have enough money.

A journey without a destination will lead nowhere. Similarly, fixing your goal before starting any investment is a crucial step. It will help you stay on the right track.

Here is a list of some important investment goals to consider

Goal 1: Retirement planning.

If your goal is to accumulate a corpus to live a peaceful life after retirement, investing your money in multiple options is very important. Firstly, you will have to decide the corpus amount you need after retirement.

Once you decide the amount, you can choose the best investment option as per your risk and return on investment. You can use our retirement corpus calculator to calculate the corpus.

Learn More: Retirement Corpus Calculator

Goal 2: Financial Freedom.

Do you want to achieve financial freedom?

If your answer is yes, then Investing is the most effective tool for reaching your goal. You become financially independent when you do not need to work for a living. You have to outpace your income.

If you don’t choose the best investment option, your path to financial freedom will be very difficult. The higher the return on investment, the easier it will be to achieve financial freedom.

The return on stock market investments is unlimited. Read our guide to plan for financial freedom.

Learn More: Guide to becoming financially independent.

Goal 3: To Generate Passive Income.

If you invest money in the proper financial instrument, this could be one of the best sources of passive income. When your passive income is more than your expenses, you become financially independent.

Learn More: Ideas to earn Passive Income from home.

Goal 4: Purchase of Home.

If you want to buy your dream home, you will need a huge amount to fulfill the dream. And if your income is less, it will become a pipe dream.

But by investing your money in the right financial instrument and earning a good return on investment, you could achieve your dream.

Goal 5: Other Family requirements.

You can also start your investment with different life goals in mind, like child education, child marriage, holiday, etc. You can invest separately for each of the life goals, and the type of investment will depend on the term and corpus amount needed to achieve the goals.

What is your risk appetite?

There are many attractive investment options available to get a high return on investment. Risk and reward are inversely proportional to each other.

Some of the options are fixed-income investments with less risk and less return.

Similarly, some investment options have variable income with moderate to high risk and moderate to high return.

So it depends on how much risk you are willing to take ?.

Type 1: Low-Risk Investment?

These types of investments are most suitable for people in the higher age bracket i.e. people with age>55. This is the age when your income level stabilizes to a certain level and you prepare yourself for retirement.

Many responsibilities pop up during this age, like Children’s higher education, marriage, etc. At this age, you can’t take the risk of losing your hard-earned money, so more than a high return, the safety of capital is essential.

Some of the low-risk investment options are – FDs, Post Office Schemes, PPF, RBI Bonds, etc.

Type 2: Moderate Risk Investment?

These types of investments are most suitable for people in the middle age bracket, i.e., people between 40 and 55. This is the age at which you actually consolidate your wealth for life after retirement.

At this age, you reap the benefit of the hard work you put in at a younger age. Your investment in this age should be diversified in nature.

You should have the right mix of fixed-income investments with moderate return and variable-income investments with high return prospects.

Type 3: High-Risk Investment?

This category of investment is most suitable for younger people with the age<40. This is the most productive age in a person’s life. At this age, you work hard and you get your salary raise very fast. You also have an appetite for higher risk and less responsibility.

You can aim for a high-risk investment option for a high return on Investment. This is the age when you build a solid foundation on which your whole life depends. You can reap the benefit of long-term investment and the power of compounding.

Learn More: Common Investing Mistakes That Every Beginner Should Avoid

So the next question is

Where to invest money for Beginners to get a good return?

There are multiple investment options available which creates confusion. You need to find the best way to invest your money. The task is not easy. You need to be smart and search for an investment option with an attractive return on investment.

But if you have clarity, why should you invest money? What is your investment goal? What is your risk appetite?

Then picking your best investment option for a high return is not a difficult task.

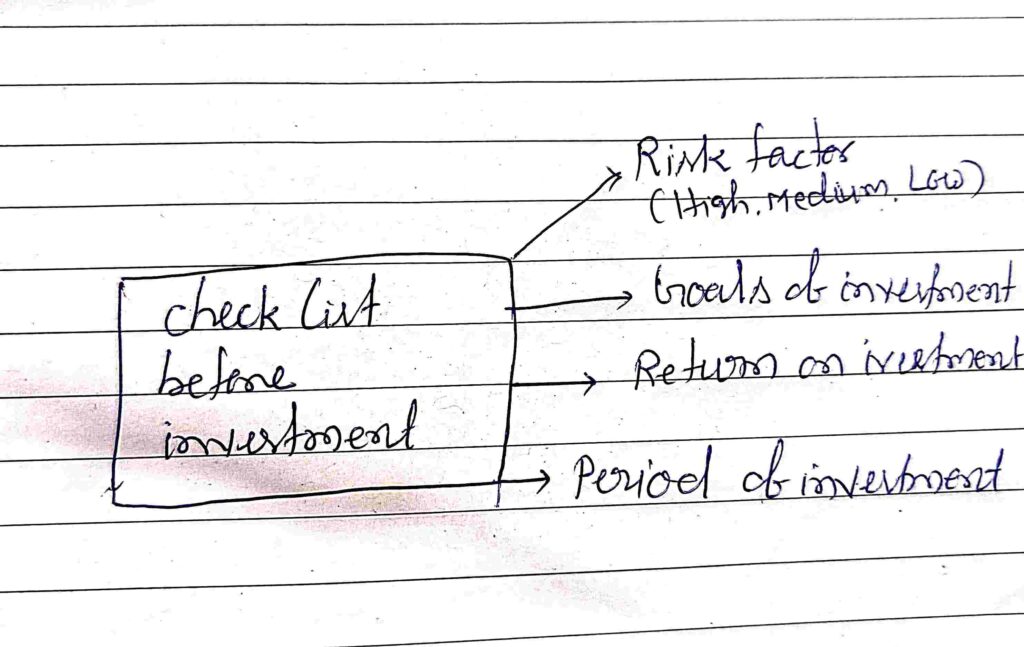

You can select the options based on Return on Investment, Risk Factor, Specific Future Goals, or Period of Investment.

Here I am going to share the best investment option on the basis of return on investment- Fixed Income Investments & Variable Income Investments.

Fixed Income Investments

This category includes those investment options that provide a fixed return on investment on a monthly/quarterly/yearly basis. If you pick any of these options, you get a guaranteed return after maturity. These Fixed income options include-

1. Public Provident Fund (PPF)

The Public Provident Fund (PPF) scheme was introduced in 1968 by the Government of India. The most attractive feature of the PPF is that it is a saving-cum-tax benefit option. You not only get a higher return on your deposits but you also get income-tax benefits.

Some of the attractive features of PPF are-

- You can start your investment with a minimum of Rs.500 and the maximum investment limited to 1.5 lakh per year.

- There is a lock-in period of 15 year in the PPF which can be extended for 5years at a time.

- You can also avail loan against your PPF deposits in case of emergency after the 3rd year of investment.

- The Government of India decides on interest from time to time. The present interest rate as of December 2020 is 7.1%, which is higher than FDs.

- You can withdraw the entire balance on maturity.

- There is also an option of premature withdrawal from the 7th year.

- The interest you earn on PPF is completely tax-free.

So during the time when interest rates are falling day by day, the PPF could be one of the best investment options for fixed and safe return.

2. Govt Schemes.

There are many attractive schemes launched by the Government from time to time to provide safe and assured return on the savings to specific groups of people. In these schemes you get a pre-fixed interest on your investment. Some of the schemes are:

Senior Citizen Savings Scheme (SCSS)

The Senior Citizen Savings Scheme (SCSS) is a government-backed scheme specifically launched for senior citizens (age>60).

Retired Civilian employees of age >55 and <60 and Defense employees of age >50 and <60 are also eligible to open the account if they invest within 1 month after receipt of the retirement benefit.

The scheme is very attractive and provides higher interest in savings. The interest rate on the scheme is 7.4% per annum (as of 1.04.2020) which is way more than regular bank deposits. You can invest a maximum up to 15 lakh in the scheme.

The period of maturity under SCSS is 5 years which could be extended for further 3 years. You have the flexibility for premature closure of the account. And above all, You also get the income tax benefit under section 80C of the Income Tax Act.

This could be the best and safe investment option for senior citizens and retired employees to get a high return on investment.

Sukanya Samridhi Accounts (SSA)

Sukanya Samriddhi Account is a Government-sponsored saving scheme for parents/guardians of girl children. The scheme encourages parents to save for future education and marriage expenses of girl children.

The SSA provides the highest return on deposits among all the fixed income instruments.The scheme was launched during the financial year 2014-15 under “Beti Bacho, Beti Padho ” Campaign by the Government of India.

Features:

- The SSA account can be opened either in any post office or an authorized bank.

- The current interest rate of the account is 7.6% per Annum(as of 01.04.20).

- It has a limit of minimum deposit of Rs.250/- to maximum deposit of Rs. 1.5 lakh in a financial year.

- The deposits under the account qualifies for the deduction under section 80C of Income Tax Act.

- The account matures when the account holder attains the age of 21 years or at the time of marriage of the account holder after the age of 18 years.

If you have a girl child and want to secure her future, Sukanya Samriddhi Account could be the most lucrative investment option. The Fixed interest interest you earn on the account is by far the highest interest you can earn in any fixed income instruments.

3. Bank/Post Office Deposits.

If you want a fixed and safe return on your savings, bank FDs/Post office Time Deposit Account (TDs) could be most suitable options. This is the most popular investment option for low risk investors.

You get a fixed interest income on a regular interval without much risk of capital depreciation. The interest you earn from the deposit ranges between 5 % to 6.7 %. The interest depends on the tenure of deposits and financial institutions chosen for your account.

As per the recent notification by the government of India, deposits including interest upto 5 lakh in a bank account are insured by Deposit Insurance and Credit Guarantee Corporation (DICGC).

This option is not suitable for the person who wants to create wealth for the future. This is just a saving option.

4. Sovereign Gold Bond (SGB) Scheme.

The Government of India launched the scheme during the financial year 2015-16 under the gold monetization scheme. The Bond is issued by the Reserve Bank of India (RBI) on behalf of the Government of India in multiple Tranche.

The rate of SGB was declared by RBI at the time of issue of every tranche. It is a kind of government security in the form of gold units.

Features:

- The SGBs are issued in the basic denominations of one gram of gold and its multiple.

- The Minimum permissible investment limit in the Bonds is for one gram with a maximum limit of investment for 4 kg for individuals.

- The tenure of Bond is 8 year with an exit option from 5th, 6th and 7th year.

- The investor gets a fixed interest of 2.5% per annum on the initial investment amount.

- The investor will get the market price of the gold at the time of redemption on maturity.

As the RBI manages this, it could be one of the best and safe investment options for low-risk investors. The scheme offers an alternative to physical gold investment.

The most attractive feature of the scheme is that it eliminates the risks and cost of storage of physical gold because SGB is in digital form. And above all, you get an assurance of the return as per the market value of gold on maturity.

So this could be one of the best options for low-risk investors.

5. Corporate Fixed Deposits

The investor who wants to invest in fixed income instruments and still wants a moderate rate of return, Corporate fixed deposits could be the best option. It is deposit accounts offered by financial institutions and NBFC.

The interest rates you earn are higher than the interest offered by the commercial banks on their FDs. Some of the Corporates and NBFC offering corporate fixed deposits are Shriram Transport Finance, Mahindra Finance, Bajaj Finance Limited, etc.

High return always comes with high risk. The same thing applies here. Corporate fixed deposits have always a risk of default when the company faces any financial crisis.

The deposit doesn’t have any guarantee of safety of investors’ capital like FDs which is actively monitored by the RBI. Further, you don’t get any tax benefits and the interest earned will be added to your total income chargeable under income tax.

So this investment option is not for conservative investors. The investor who is willing to take the above risk for assured return should only go for corporate fixed deposits.

Variable Income Investments

1. Real Estate Investments.

Real estate could be an attractive investment option for high saving corpus individuals. I have kept it under variable income investment options because there is no fixed return on investment. You can invest in land, flats, commercial spaces, etc.

You can either buy a commercial property and rent it out or earn profit from cost appreciation by selling a property.

However, the main drawback of investing in real estate projects is the huge amount of investment. You need a big corpus to buy a property in a prime location, and building a big corpus takes time and energy. So, you need to plan early; otherwise, you may be caught in a debt trap.

Another disadvantage of investing in real estate projects is that the liquidity is very low which means you cannot sell the property instantly. It takes time to find the right buyer.

If you don’t have a big corpus and still want to generate income from real estate, investing in a Real Estate Investment Trust (REIT) could be the best investment option for you.

REIT was first introduced in 2007 by SEBI. The main purpose of the REIT is to solve the fund cruch in the real estate sector by attracting investors through generating income for investors and growing the sector.

It provides a golden opportunity to all investors to invest in real estate and get benefited from the dividend income. It is mandatory for REIT to distribute 90% of profits among investors.

REIT invests in a wide range of properties like- shopping malls, rental properties, commercial properties, infrastructure projects, apartments or buildings, etc.

You can invest in REIT through IPO and after stock market listing it can be traded in the stock market. Some of the REITs are –Embassy Office Parks REIT, Mindspace Business Parks REIT, etc.

Embassy Office Parks REIT was listed on the stock exchange in April 2019 at the price of Rs.308. The current market price is Rs.346. So it has given a return of around 10 % since launch.

Further, it has also distributed a total dividend of Rs.35.72/share since launch which means a return of approx. 11%. So absolute return is 21% since launch (as of December 2020).

The biggest advantage of REIT is that it is highly liquid and can be bought and sold in the market. Imagine when you need money for an emergency and have to sell a physical property, it becomes a daunting task. Sometimes it takes years to find a buyer for your property.

By investing in REITs, you can also diversify your portfolio without managing physical property. While buying physical property, you invest in one or two projects and have to stick to them, which is more susceptible to risk.

But in REIT you invest in a basket of high-performing property. So you are not sticking to 1 or 2 projects which makes it less risky.

Since the SEBI regulates it, there is a lot of transparency in dealing while investing in REIT Which is not possible in Physical Property.

So if you want to generate a steady flow of income REIT could be one of the best investment options in India to get a consistent return on investment.

2. National Pension System (NPS)

The National Pension System (NPS) was launched by the Government of India in 2004 as an alternative to the Old pension Scheme.

The Scheme is regulated by Pension Fund Regulatory and Development Authority (PFRDA) through National Pension System Trust (NPST). The NPST takes care of the funds under NPS for the benefit of subscribers.

The dual purpose of the NPS was to lessen the burden of pension on the government exchequer and also to provide old age security through investing the NPS corpus in safe and regulated funds and then mandatory buying of annuity plans from the maturity amount at the time exit.

It was mainly launched for government employees where 10% of the basic salary was deducted compulsorily from the employee’s salary, and a matching contribution of 10% was made by the government and invested in a defined pension fund through an NPS account.

Government contribution was increased to 14% of the salary w.e.f. 1.04.2019.

The NPS was opened for subscription for all citizens of India from May 2009. Now anyone can voluntarily contribute to an NPS Account (no government contribution) and gain a reasonable market-based return in the long term and accumulate a corpus for old-age income.

You can exit from the NPS at the time of superannuation or any time after the completion of 10 years.If you exit at the time of superannuation, you need to compulsorily invest 40% of the fund in an Annuity pension plan.

If you exit before superannuation you need to buy an annuity plan with 80% of the fund. So in this way, it guarantees consistent old-age income and security.

The historical annualized return of investment in pension funds is about 10%. Which is a moderate return and higher than the return given by many mutual funds.

The best part is NPS has two tiers i.e. Tier-I and tier-II while the contribution in tier-I is fixed, in the tier-II account, you can invest as per your wish and also withdraw the amount whenever you want.

So In my opinion, everyone should invest in NPS some portion of their savings for old age income security.

3. Stock Market Investments.

The stock market is by far the most attractive and rewarding investment option. If you want a high return on investment and grow your investment exponentially, the stock market is the best investment option.

Here you have a no-fixed return on investment. If you have the skill and expertise then the only sky’s the limit. You can even double your money within a month or year. But getting high is not easy.

Initially, you have to invest a lot of time and energy to gain expertise in the stock market. High return always comes with high risk of losing your capital. One mistake and your investment will be wiped out. There is always a risk involved in Stock Market Investment.

You can start investing by opening your DEMAT and Trading Account with any of the reputed brokerage houses like- Zerodha, ICICI Direct, Angel Broking, etc. Once you have a DEMAT Account, there are many ways of investing in the stock market. Some of the popular methods are:

Purchase of Stocks in a company

In this method, You directly buy the shares of a particular company listed on the stock exchange. You make a profit by selling those shares when the market price of the shares is higher than the cost price.

So in this process, the difference of market price and cost price is your profit.

The basic idea to earning income is to buy at a lower price and sell at a higher price.

Dividend return

If instead of selling the shares at a higher price, you hold the shares for the long term, you get some portion of profit earned by the company i.e. Dividends.

The dividend could be one of the good sources of passive income from the Stock Market. There are companies that pay more than 6% Dividends on an annual basis.

Mutual Fund

If you don’t have time to actively invest in the stock market, a mutual fund could be one of the best options for you.

Mutual funds generally consist of a basket of many shares so it limits the risks. In mutual fund, there are fund managers who manage your investments and charges some fees.

You can invest in a mutual fund either through SIP mode or lumpsum mode. If you see the historical return, mutual funds are suitable for moderate return. The return depends on the kinds of fund you choose e.g. Equity Funds, Debt Fund, Liquid Fund, etc.

Bottom Line

The correct answer to the question- how to invest money to get a high return on investment involves a long process.

The process starts with reasons for investment, fixing the long-term or short-term goals, finding your risk appetite, the time horizon for investment, and lastly choosing the right investment option as per your need.

Secret Tips: As I promised, I will share my secret tips about investment. If you read the whole article you would have understood the secrets. My secret tip is – Before any investment, invest in yourself.

Do you know what is the best investment option for your whole life?

The most valuable investment that will always give a high return on investment is Investing in Yourself. Investment in educating yourself and acquiring new skills.

With this, I would like to conclude this long post. I hope you like the article. If you have any suggestions or queries, feel free to comment. And

What do you think of the best investment option for you?

I would love to know your ideas.

Cheers

- Earn money online from Chegg (as a Student, Teacher) : An ultimate guide

- Eight Reasons – why you must invest in the stock market?

- Top 22 genuine mobile apps to earn money online with no investment

- Practical ways to make money through Online Content Writing

- Beginner’s Guide on how to invest your money smartly.

- Best books on the Indian Stock Market for Beginners

Disclaimer: Some links in the post may contain affiliate links and we may receive a commission if you click and purchase from our links. Further, All contents of this blog are for educational purpose only and are purely individual opinions. It is recommended to consult your financial advisor before making any investment. For more detail please read our disclaimer.

Subscribe to our weekly newsletter and never miss the latest TIPS on Smart Income Ideas to Make Money Online. No Spam, No promotion. You will get only one newsletter per week. Get your copy now

Thanks for your blog, nice to read. Do not stop.

Great compilation & very useful for making future secured