Do you use OYO? If Yes, this post will guide you on how to use OYO Money. OYO Money is a convenient and secure way to pay for your stays at OYO hotels worldwide. Further, you can also pay for other services and products offered through the platform.

In this blog post, we’ll discuss everything you need to know about OYO money, including how to get It, how to use it, what it can be used for, and its benefits.

In this post, I will talk about;

- What is OYO Money?

- What are the benefits of using OYO money?

- What are the disadvantages of OYO Money?

- How to earn Oyo money?

- How to Use Oyo Money?

- OYO money vs. OYO rupee

- Important tips while using Oyo money

What Is Oyo Money?

Oyo Money is a virtual currency of OYO and is stored in a digital wallet launched by OYO (On your own) Rooms, a leading hospitality company.

Oyo money enables you to store your money safely inside the Oyo app and use it while booking hotels at Oyo money applicable hotels. You can also book Oyo townhouses, Capital O luxury motels, and other hotel booking services available at specific locations worldwide.

What are the benefits of using OYO money?

Oyo Money has several benefits. Some of the significant benefits of Oyo Money are:-

- OYO money is a digital wallet that can be used to make bookings and payments on the OYO app, which makes it a safe, convenient, and easy way to make payments for Oyo hotel bookings.

- You can easily store money in the wallet and use it to pay for services without worrying about carrying cash.

- Oyo Money also allows you to earn rewards and discounts on select services when you use the wallet.

- OYO money is accepted at all OYO-affiliated hotels. You can use it to book your room and enjoy staying in a peaceful facility.

- OYO money is a great way to save money on your hotel stay. You can use it to get discounts on your room rate, order food, and pay for other services.

- Finally, you can save money whenever you stay at an OYO room and use them for further stay on partner websites.

READ MORE: An Ultimate Guide: Tips on How to Save Money from Salary

What are the disadvantages of OYO Money?

While OYO money has many advantages for travelers, it also has some limitations. Here are some of the disadvantages of OYO Money.

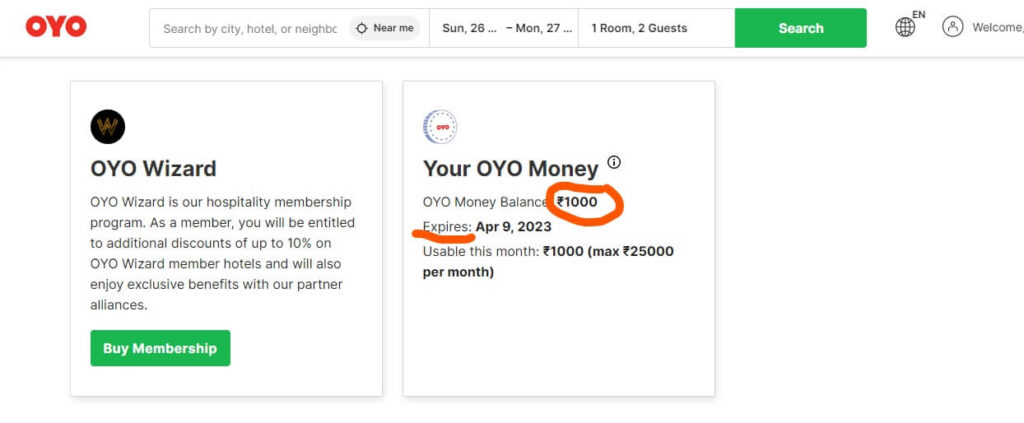

- OYO Money is to be redeemed within its expiry period; otherwise, it may lose its worth. For Example, I earned Rs.1000 as OYO Money on 26th March 2023. However, I will have to use it within 15 days as it will expire on 9th April 2023.

- OYO money could be used only on bookings at OYO-affiliated partners.

How to earn Oyo money?

OYO Money is a virtual currency you can earn by participating in activities or contests on the OYO app.

To earn OYO money, open the OYO app and go to the ‘wallet’ section. You will find a list of all the available offers which you can use to earn OYO money. Click on any of the offers to know more about them, and click on ‘Redeem’ to start earning Oyo money.

You can also earn OYO money (up to a maximum OYO money wallet limit of ₹ 25000 per month in India) in three ways.

1. Earn Oyo money on the First Signup.

You can earn a complimentary reward of ₹1000 Oyo money when you complete the signup process with your valid name and mobile number. However, the only demerit is that it is valid only for 15 days.

2. Earn Oyo money by Play & Earn

You can earn Oyo money while playing games in your idle time on the Oyo app play and earn section. The more you play, the more you can earn Oyo money and other monthly/weekly leaderboard rank-based rewards by scoring more points.

3. Earn Oyo money on your every stay at Oyo rooms.

You can also use your earned OYO money while booking a room at any participating OYO hotel. Select the ‘OYO Money Applicable Hotels’ option and choose the hotel that offers this facility.

You can apply for your earned money while booking and save extra cash.

After a successful stay at Oyo money applicable hotels, you will get a reward credited in the form of Oyo money in your wallet.

How to Use Oyo Money?

Are you wondering how to use Oyo money in the Oyo app, and can you use Oyo money while booking?

Don’t worry; using Oyo Money is easy and straightforward. To use Oyo Money, all you need is an Oyo account. Once you have signed up for an account, you can use Oyo Money immediately.

It does not require you to go for additional formalities for activating the Oyo money wallet as you have already earned ₹1000 at the time of Signup.

You can easily use your Oyo Money to pay for bookings at Oyo-affiliated hotels. You can use Oyo money in the following manners:

- You can redeem your Oyo money from the Oyo play and earn reward section inside the app. Here you can see the rewards from playing games in the form of Oyo money credited into your Oyo money wallet.

- You can choose the Oyo money applicable hotel, and a respective amount will be deducted from the Oyo money wallet.

- You can pay the balance amount at the time of checkout from the hotel by paying online through UPI, a debit card, or by Oyo wallet money transfer.

- You can choose to pay with Oyo Money directly at the time of making full payment. This will give you discounts and other benefits in the form of earning more Oyo money after completing your stay at the hotel.

- You can also use Oyo Money by redeeming it for discounts on future bookings.

OYO money vs. OYO rupee

While using the Oyo App, you should know the differences between Oyo Money and Oyo Rupee.

Oyo Money is a virtual currency you can earn by participating in activities, playing games, or contests on the OYO app.

On the other hand, OYO Rupees are real money equivalent to real cash and can be earned by referring friends to the Oyo app.

You can earn ₹20 Oyo rupees whenever your friend Signup the app and ₹200 Oyo rupees at successful checkout. ( The maximum limit of inviting your friends is 10 per month)

Note: 1 Oyo rupee = ₹ 1

Important tips while using Oyo money

When you use Oyo Money, there are a few things to remember while finding an answer. Can I use Oyo money for booking?

- Oyo Money can only be utilized and redeemed to make payments for bookings at “OYO Money Applicable Hotels.”

- Oyo money can expire if you don’t use it within a given time.

- Suppose you are looking for how to transfer Oyo money to a bank account. In that case, it is to be noted that any customer cannot transfer the Oyo Money balance to their bank account or for any other kind of payment, excluding hotel booking.

- Oyo money cannot settle your full payments towards hotel booking. It only gives a partial deduction from the Oyo money wallet.

- In case of refunds or cancellations, you can use the Oyo Money refund feature, which will instantly credit your account with the amount after deducting applicable charges.

- You need to pay the balance of the hotel booking when making a payment with Oyo Cash or Oyo Rupee.

- Oyo Cash is an instant payment method that deducts money from your UPI/bank account.

- On the other hand, Oyo Rupee is an advance payment option that locks your money until you complete the transaction.

- You can use and settle the booking amount with your Oyo rupee, as 1 Oyo rupee is equivalent to ₹ 1 cash rupee.

Final Thoughts

Oyo Money is a great way to make partial payments for hotel bookings and save money on every stay. This has made life easier for customers as they don’t need to carry extra cash or cards.

With its easy-to-use interface and secure payment system, Oyo Money is an excellent choice for customers who want to make payments quickly and conveniently. However, the only disadvantage of OYO money is that you must use it within its expiry period.

So, if your job or business needs regular traveling, consider using Oyo Money. OYO money could be a convenient and secure way to make payments online without carrying cash and save money.

I tried to cover every aspect of how to earn and use OYO money and save money on your next stay. If you have any doubts and suggestion, please let me know in the comment section.

Frequently Asked Questions (FAQs)

What is OYO money?

OYO money is a digital currency or virtual wallet offered by OYO Rooms, a hospitality company. It allows users to earn and accumulate credits through various promotions, offers, and loyalty programs within the OYO ecosystem. These credits can be used to pay for future hotel bookings and services provided by OYO.

Can we convert OYO money to cash?

Typically, OYO money cannot be directly converted into cash. It is intended to be used within the OYO platform for hotel bookings and related services. However, some promotions or offers may allow users to redeem a portion of their OYO money for discounts on bookings, but it cannot be exchanged for physical currency.

Is OYO making money?

As per the latest available information, OYO has pursued various revenue streams, including hotel bookings, franchise fees, management fees, and commission from hotel partners. However, the profitability of OYO as a company may vary depending on factors such as operational expenses, market conditions, and strategic investments.

What is the difference between OYO Rupee and OYO money?

OYO Rupee and OYO money are essentially the same thing; they both refer to the virtual currency or credits offered by OYO. The term “OYO Rupee” may be used interchangeably with “OYO money” to denote the credits earned and used within the OYO platform.

What is the use of OYO rupee?

OYO rupee, or OYO money, can be used to pay for hotel bookings, room upgrades, and other services offered by OYO. Users can redeem their OYO rupee credits at the time of booking to avail discounts or cashback on their reservations, thereby reducing the overall cost of their stay.

How can I transfer my OYO rupee to a bank account?

Currently, OYO rupee or OYO money cannot be transferred directly to a bank account as it is intended for use within the OYO platform. However, you can use your OYO money to pay for hotel bookings and related services through the OYO app or website.

- Is Navi Loan App Fake or Real? – An ultimate Review

- Best Buy Now Pay Later Apps in India

- Ultimate Niyo global Card Review – Best card for international trip

- Genuine Untraceable Money Transfer Apps for secure transaction in India

- How to earn and use OYO Money and Save Money for Your next Stay at OYO

- Fi Money vs Jupiter App: Which is the best neo-bank in India?

Disclaimer: The above article is for educational purposes only. We have tried my level best to present all the pros and cons of OYO Money as per my experience. However, we disclaims any responsibility for any monetary implications arising due to usage of above features. Always refer to companies website for latest offers and features. We don’t endorse the OYO in any way. Some links on this page may contain affiliate links and we may receive a commission if you click and purchase from the links. For more detail, please read our disclaimer.

Subscribe to Learn Smart Income Ideas

Subscribe to our weekly newsletter and never miss the latest TIPS on Smart Income Ideas to Make Money Online. No Spam, No promotion. You will get only one newsletter per week. Get your copy now